The Chain Store Paradox

There is a rational explanation for the failure of DOGE. We might not like it.

In game theory, there is a famous paper called “The Chainstore Paradox.” Here’s a summary from Wikipedia:

“The chain store paradox is a game theory problem that challenges conventional rational choice assumptions about strategic behavior in sequential games. It describes a scenario where an incumbent chain store faces sequential entry threats from multiple potential competitors in different markets. The paradox emerges from the conflict between two compelling strategies: the logically sound approach of backward induction prescribed by classical game theory, and the intuitively appealing "deterrence strategy" that involves building a reputation for aggressive behavior to discourage future market entry. While standard equilibrium analysis suggests the chain store should accommodate all entrants, real-world business behavior often follows the deterrence approach, creating an apparent contradiction between game-theoretic predictions and observed strategic decisions. This paradox has implications for behavioral economics, industrial organization, and the study of credible threats in strategic interactions.”

In a sequential game, Bob and Joe take turns. Bob makes his move. Joe sees Bob’s move and then Joe makes his move. And then Bob makes another move. And so on. Chess is a sequential game, for example.

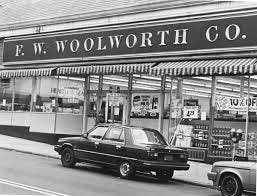

Consider a version of the chain store game. There are two stores, A and B. They are located right next to one another, say in the middle of the neighborhood. Some people are located closer to A and others are closer to B. They sell exactly the same things. A and B compete for all the business in the neighborhood. In alternating periods, A and B set their prices. A sets his price and they are fixed until he gets the opportunity to change them. If, in any period, B aggressively lowers prices, B can capture all the market share. To deter B from doing so, A must have a credible threat of retribution. One such strategy is to employ a “tit-for-tat” approach: A wants B to believe that A will aggressively lower prices to profit-destroying levels if B pursues this path. Similarly, B wants A to believe that B will respond aggressively to any deviation from the level at which they can both split the market and enjoy healthy profits. The tit-for-tat approach is one of mutually assured destruction, in a sense. It only works if A believes B will follow through on his threat (and vice versa). This is the credibility part.

If the game goes on forever, then tit-for-tat works and our two entrepreneurs have maximized the total profits of the system, sharing it equally.

However, if there are a finite number of periods, say twenty, after which the game ends, well, the outcome is different.

Let’s say it’s B turn to move in the final period. He doesn’t need to fear retribution from A because there is no tomorrow. So, the rational strategy for him to pursue is to price a little lower than A and grab all the market share. His profit margin may be slightly lower per unit, but he’s selling so many more units that his overall profit is higher.

A can figure this out. He knows B will screw him over in period twenty. The rational thing for A to do is to screw over B in period nineteen the same way.

B can figure this out, so he decides to screw over A in period eighteen.

Taking this pattern to its logical conclusion, A will screw over B in period one.

I thought of the chain store paradox when I read this passage in Ian Brodie’s The Thursday Question:

‘Some readers poked fun at my prediction a few weeks ago of an American debt crisis. But if the country is headed to an empire-ending debt pile on, then the only thing left to do is for every faction to make sure it gets its share of what’s left before the great foreclosure begins. In game theory, the solution to all coordination and prisoner’s dilemma games is trust between the players. Reining in my appetite for more spending relies on my trust that you’ll do your share of the reining in, even as you trust me that I’m committed to doing my part. Group-versus-group envy, the stock in trade of academic leftism and right wing political mobilization, has wrung social trust out of the system. After DOGE, now what?’

Regulators and bureaucrats have tremendous discretion in implementing the laws that Congress passes. This is similar to what President Obama referred to as “prosecutorial discretion” in choosing to enforce immigration laws selectively.

‘Since the spring of 2010, the Department of Homeland Security (DHS) has emphasized the need to ensure that its limited immigration enforcement resources are strategically and systematically targeted toward high-priority noncitizens. To that end, immigration agents, officers, and prosecutors within all immigration agencies — Immigration and Customs Enforcement (ICE), U.S. Citizenship and Immigration Services (USCIS), and Customs and Border Protection (CBP) — have been instructed to exercise prosecutorial discretion in deciding whom to place in removal proceedings and whom to ultimately deport.’

Citing ostensibly limited resources, Obama instructed immigration officials to only go after those deemed to be a threat to public safety, essentially ignoring everyone else here illegally.

Another dimension to this bureaucratic discretion is the apparent flip-flopping in the executive branch. Agencies and individuals were for things before they were against them, with this back-and-forth often coinciding with changes in administration.

If you’re a bureaucrat with a senior position and you believe that the United States is a finite-period game, then all bets are off by the logic of the chain store paradox.

You might as well proceed as if the end of the American experiment is today, if you believe that it will end anytime soon.

This is what it means to say that every faction gets some portion of the spoils. We touched on this with the discussion last week of the Energy Department’s Loan Programs Office, a slush fund that benefited the Greentech companies with loan guarantees and other funding, only for the recipient firms to end up going Tango Uniform in short order. It is of a piece with the controversy surrounding the $2B grant from the EPA to a non-profit with no previous substantive fundraising track record, connected to a politically active person.

I’m not arguing that the US is in a finite period game. All I’m saying is that, on the face of it, there are people in the bureaucracy who seem to act as if they believe that to be the case and who are willing and able to pull the fiscal levers to direct resources to sympathetic factions.

Where are the controls?

If the establishment shares this orientation, even subconsciously, it’s no wonder that Musk struggled to cut costs. The bureaucrats would deem such an exercise pointless and even wasteful.

Maybe that’s the real explanation for what happened to DOGE.